With multiple locations, managerial accounting can be as simple or complicated as you desire. Some flight schools opt for a very basic solution while others prefer itemizing items by location for rich reporting. Even if you prefer a simple solution now you may consider configuring as described here in case you prefer detailed financials later.

Aircraft Usage

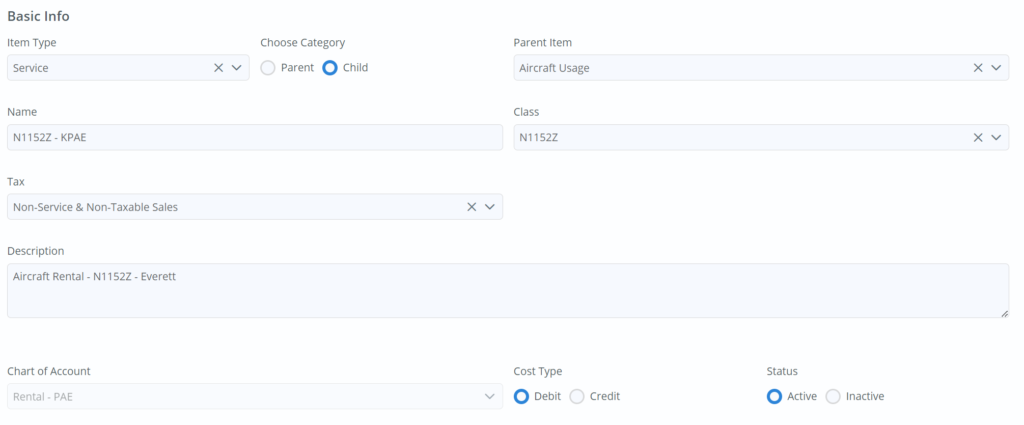

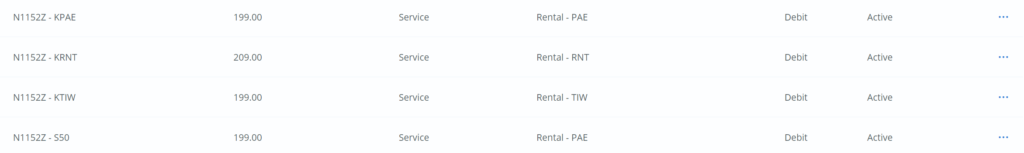

In your Accounting > Items list you already have an item created and mapped for aircraft charges. This is perfectly fine as you can move the aircraft between locations as the tax will be calculated based on rate in Settings. But if you occasionally move the aircraft you may wish to itemize hours at each. To do this, simply duplicate the applicable item with a unique name – in this example the registration and airport ID. Financial reports will reflect each item.

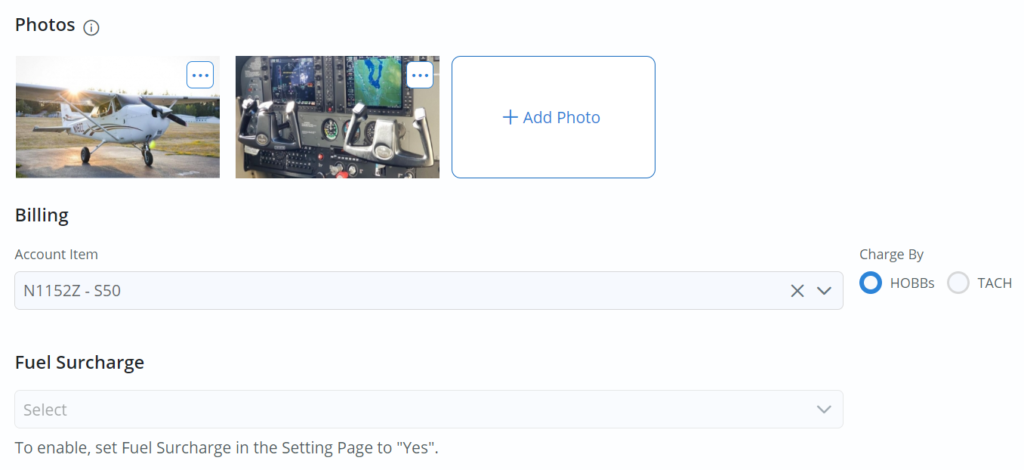

When moving aircraft, just remember to update the billing item in aircraft details so usage is reflected with correct mapping.

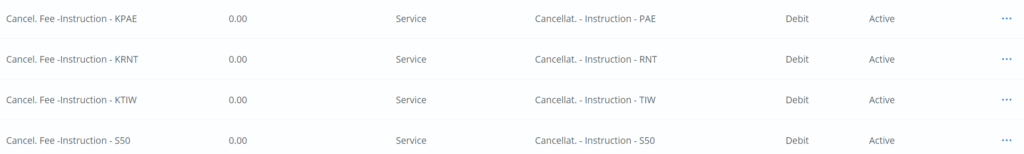

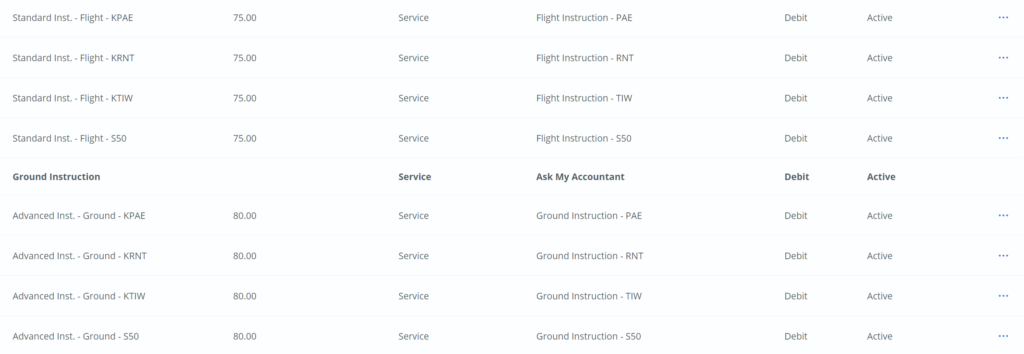

Other Items

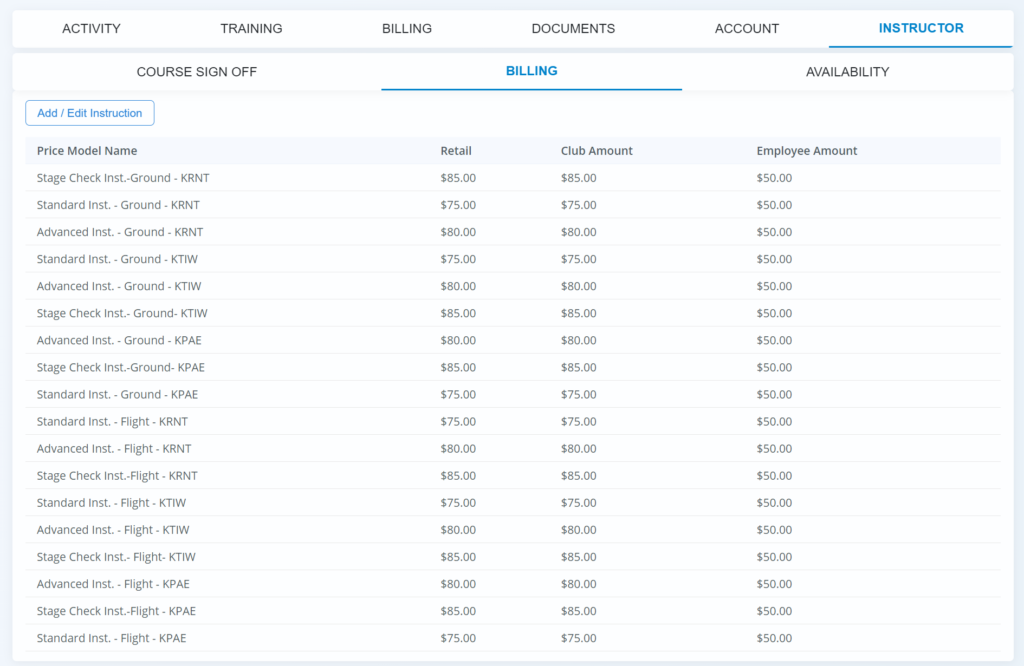

You may want to likewise track other items including Flight Instruction, Ground Instruction, Discovery Flights, Cancellation Fees – anything you wish to track. Apply the same steps by duplicating items with unique name.

If instructors are teaching at multiple locations, don’t forget to approve these new billing items in instructor profile so they can properly enter item during check in for proper reporting.